During fundraising, most founders should optimize for speed, but not at the expense of getting the wrong people on your cap table. 1 Be careful with your expectations: one round of speed dating does not often lead to a long and successful marriage. And like any marriage, it’s pretty difficult (and expensive) to escape. Choosing well is the most important factor to a successful marriage. This is the same for your cap table. Your choice of partners is everything.

Founders should prepare for the strongest cap table as quickly as possible.

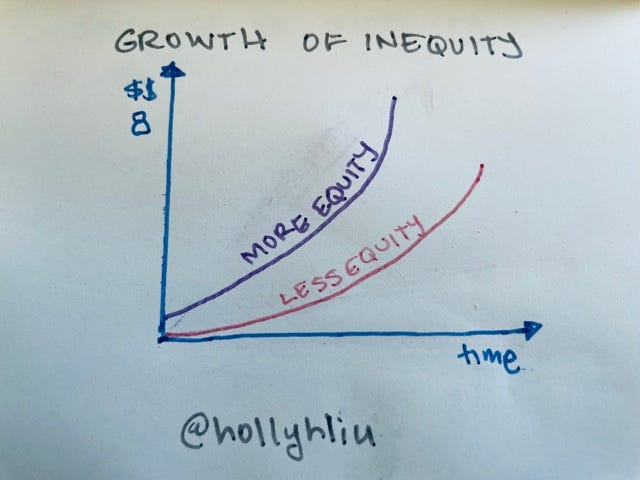

The good news! Founders have 100% control of their cap table. Problems can both be fixed and fester here. The cap table is the story of company ownership and as business grows, the problems caused by the cap table continues to widen, and become harder to correct.

We tried to fix the equity for one of the founders several years after the company started and it was incredibly difficult even as we overcorrected to make up for all the time his equity would have vested. Moral of the story: work to get equity ownership as “right” as possible in the beginning.

Part of building the strongest cap table means including folks you might not initially think to include. That means diversity.2 Allowing underrepresented investors onto your cap table takes intentionality and time, but securing them will unlock new opportunities to reach more deeply into your market. These investors can connect you to other investors for later rounds and set you up for a longer term future. And thus a stronger cap table.

Alone you go faster, together you go farther.

The best way to build the strongest cap table is to avoid the following mistakes:

#1 - Not being intentional

Creating something that does not exist demands vision, intention and execution. You are in charge of your cap table so you can decide who is on your cap table. Like a gardener, you can determine the types of seeds that come into your garden. Seeds are like the investors, and seed diversity not only increases a stronger ecosystem, but spreads out the risk. 3

The biggest objection to getting diverse investors is that it takes too much time. This can be addressed upfront during the preparation phase of your fundraise. 4 A gardener plans what types of seeds they want. If it’s a diverse garden she will spend time researching and getting the right seeds during the planning phase.

#2 - Not setting a goal or communicating your intentions

Set a target and communicate the target or intentions. Founders who are raising will let me know they want a diverse round. But if they don’t communicate that intention, I assume they just want money, and may send them to the same set of male, white investors loaded with capital. Communicate your intentions to your investors or potential investors and it can change the course of who you are introduced to, and who invests in your company.

Also founders: communicate your intentions to your existing investors. You are so busy building your company that you won't know all the up and coming investors, but your investor might!

During YC, a black founder was making room for other black investors, and told me. Within one text message, I was able to connect them to a black emerging fund manager and an investment happened right on the spot.

#3 - Not allowing time for women and other underrepresented investors

The most common way people become angel investors is they have a large exit and are able to use those proceeds to continue funding the ecosystem. With so many white men having large exits, either as early employees or founders, it easily perpetuates the cycle to fund people who look like themselves. 5

Underrepresented investors may likely be new to investing. Allow the investor around 2-4 weeks to make a decision. The normal seed fundraise takes about 3-4 months, so you can have these conversations in parallel to save time.

Many founders come to me wanting a decision within a day, partly because their round is moving so fast. But if I just met you, it takes some time to get to know you and fully understand how I can help. Conversely, founders should not be accepting offers to invest on the spot - take a day to talk it over with your co-founder and think about it. If the investor you want is familiar with investing, they should decide fast, but since there are less underrepresented ones, you may need to give them more time. Offer to connect them with an existing investor. Help them get as comfortable and excited as possible, as quickly as possible.

#4 - Not allowing for smaller checks

If an underrepresented investor gets a large exit from being a previous founder, they are likely not exiting with as much money as their male counterpart. On average, founder equity for women is $0.39 to every $1. The ecosystem gives us less, therefore we have less to put back in.

I was speaking with a founder who wanted to raise a $400K round with only four angels on the cap table, which means a minimum of $100K per person. I told her immediately that my average check size was not that high and if she wanted to get more underrepresented investors on the cap table to allow for smaller checks.

Roll-up vehicles are a good way for a founder to allow for smaller checks and diversify their cap table. AngelList has provided roll-up vehicles for founders to take small checks if there are a lot of strategic people you want but they can’t meet a minimum check size. The roll-up vehicle will roll them up into one entity. It can be a pain to chase signatures for the smaller checks, so I usually recommend you take no less than $10K directly from the investors. But, in a roll-up vehicle checks can be as small as $1K since you’ll only chase one signature for all the money.

Syndicates are another good way for a founder to allow for smaller checks and diversify their cap table. Syndicates require a syndicate lead who will represent the deal to their investors. Syndicate leads will talk to the founder. If they like the opportunity, they will ask for an allocation amount from the founder and then fill it with money from their LPs (Limited Partners or investors). These LPs can invest as little as $1,000, into a vehicle called an SPV (Special Purpose Vehicle). This SPV will be seen as one line on your cap table. Syndicates can sometimes take awhile to “fill the allocation”, and are seen as the slowest investors. But with this funding environment I’ve run syndicates that took less than 2 days to fill a $500K allocation. If you go the syndicate route, you should allocate at least $150K due to the fees incurred from the syndicate lead and platforms like AngelList.

Also, a growing number of emerging fund managers are not only looking for underrepresented founders to invest in, but also introducing underrepresented investors access to these investment opportunities, which traditionally have only been available to white men. Here are a few: Backstage Capital, The Community Fund (Lolita Taub), Portfolia (Trish Costello), HustleFund (Elizabeth Yin), and Overlooked Ventures .

#5 - Not capping your investors to a max amount

While one founder wanted only four angels on the cap table, I had a friend do the exact opposite.

They wanted to raise a “friends and family round”, and for a company that required a lot of business development relationships. They didn’t want one investor taking up the majority of the round. They did the opposite and capped each investor at a maximum of $50K. They raised $1.5M with no one investor putting in more than $50K. They knew that it would not be great for their business if they could not get more investors onboard.

This situation works if you have a seed round with a ton of interest. Your seed round may not have a lot of interest in the beginning, but as you fundraise that can quickly change. If you find yourself with a lot of interest, and you can save $150K - $200K for diverse investors.

#6 - Not saving a portion of your round

This mistake is in lock step with the one above. Oftentimes, founders are looking at $0 and few prospects at the beginning of their fundraising process, so they need any dollar they can get. Founders start raising with their closest friends and family 6, and then move further to less personally known, larger checks (aka seed funds). If the initial group of friends and family takes some time, you can save a portion of your round and then circle back when you get the rest filled, but be upfront with them if and as the cap changes. 7 If you can do this with friends and family money, do this with diverse investors, and contact them first.8

I pinged a founding team who wanted a diverse cap table two weeks before they started fundraising . In the meantime I introduced them to a few customers. Two weeks later when they were fundraising, I found out during those two weeks they raised money from all white men and did not save any for diverse investors. And, the valuation cap had increased. While fundraising can move fast they did not save a portion of their round for diverse investors. And, they gave worse terms to diverse investors! I told them I couldn’t invest or bring other women to invest at a higher valuation.

They should have saved some of their round (even $100K would have been great!) when they began taking money. Then, they should have contacted me and their underrepresented investors to give us a chance at the initial terms. This could have all been avoided had they saved a portion of their allocation.

#7 - Not working the chain of introductions

Investing happens in groups, usually underrepresented investors build these networks or work hard to get into established ones full of people that don’t look like themselves. As an underrepresented investor myself, I am often the only female investor in a room. As a fund lead, I’ll often later find that the deal or introduction went to the other men instead of me.

Conversely, when you find one underrepresented investor, ask them to introduce you to their investor friends. I might know you if you are an Asian founder, and I might know you if you are a gaming founder, but if you are an Asian gaming founder, my hit rate is almost 100% that I know you.

Derek Andersen, CEO and founder of Bevy and Startup Grind raised a Series C and intentionally got 20% black investors on the cap table.

One of those investors, James Lowery, who is a management consultant and entrepreneur, and was the first Black employee hired at McKinsey in 1968, sees the opportunity for this approach to be a model to attract investment from other under-represented groups.

“I know for a fact because of my friendship and my network that there are a lot of people, if they had the opportunity to invest in opportunities like this, they will do it, and they have the money to do it. And I think we can be the model for the nation,” Lowery said.

#8 - Not asking operators

Operators are high level executives within a mid to large size company with executive salaries. And they often know how to get the work done, sometimes better than the CEO 😝. Be open to taking a smaller check directly from them, as a lot of them are not liquid.

Mallen Yun runs a fund, Operator Collective, full of executives and founders who have invested in the fund. Access to these operators can be helpful and strategic, since they might become potential customers of your company.

#9 - Not sending a cold Tweet, cold email, cold DM

VC Twitter has been helpful in this regard for founders. Investors love building their brand on Twitter, so a cold tweet can be incredibly helpful.

A cold tweet worked for this founder, with < 2,000 followers:

This was the cold tweet:

Extend that to a cold email or a cold DM. I’ve invested on a cold DM before. This also means the founder researched the potential investor well and made sure the investor’s background was incredibly strategic to building their business.

#10 - Not allowing customers to invest

I love love love what Wes Kao and Gagan Biyani did with their new company Maven, a cohorted program edtech platform. They partnered with a crowdfunding site, Republic, to allow non-accredited investors to invest and opened up a portion of their round to folks who were potential customers to invest as low as $100. 9 Customers are the flywheel of your business, what better way to build a long term relationship with them than allowing them to invest.

#11 - Bonus Mistake (with a Warning): Not offering advisory shares

I’ve saved the most uncommon and non-obvious tip for last. And, many will advise against this tip. But, if you are trying for the best cap table, it is an option. For the super strategic investors who have little to no capital, you can bring them onto the cap table by giving them advisory shares. Always try to see if they will invest with whatever they can afford, as being on the cap table inherently makes them aligned and an advisor. But for super strategic investors, you may want to bump them up with some advisory shares to give them more skin in the game. 10

I’ve had two founders who were looking for me to be on the cap table and asked me to invest. Since my check size is tiny, they added advisory shares so my total would be 0.25%. This allowed me to have a portion of my shares vest, which allowed the founder to set up an ongoing touch point and make me work for those advisory shares. They were also subject to a vesting schedule like all common stock should be. Preferred stock has no vesting schedule so the investor owns the shares when they give you money (or when their investment converts in a priced round).

The common advice is not to give advisory shares to investors because they are just asking for “freebies”. There are horror stories of investors getting more ownership of the company or a better deal by taking advantage of the founders. However, most of the common advice has been given by either white investors who are interested in protecting more allocation for themselves or founders who gave too much away or didn’t give advisory shares in a standard way. Also, when hearing the advice as an underrepresented investor I cringe because of the assumption of privilege it comes from having capital that is liquid.

But if you stay in the standard amount of what to give advisors (no more than 0.25%) over a vesting schedule (two years, monthly vesting), then I think it’s fine, especially if you want that underrepresented investor on your cap table. 11 Also, advisory shares are common stock, which are given to founders and employees, with the same treatment, therefore, tying the advisor to the same incentives and time horizons. The advisor doesn’t own the advisory shares outright, they need to work for them and you can fire them as an advisor too.

So, your cap table is a crap table because you didn’t take the time upfront to put in a little bit of unconventional thought. Avoid the above ten mistakes, and your diverse cap table will lay the groundwork for a strong, valuable, and long lasting business.

This article was sourced from this one tweet:

Huge thank you to all who shared your wisdom. If you are on Twitter, give them a follow! Mallun Yun , Lolita Taub, Meghan Holsten-Alexander, Arlan Hamilton, Yehong Zhu, Monique Woodward, Kimberly Bryant, Elizabeth Yin,Kristen Anderson, Janine Sickmeyer,Lan Xuezhao, Ruben Harris, Michelle You, Julia Lipton, Trish Costello, and All Raise . And if I missed anyone, it was not on purpose, and please feel free to drop your handle in the comments below!

If you want to save a founder from building a crap table, make sure to share this article with them!

🙏 Many thanks to Jay Rosenkrantz from Wordloops for reading drafts and providing the space to think and write online. ✍️ Join Wordloops and after 7-day free trial, coupon code for 25% off first month: foundermusings!

this is the weakest thing i've read from you (and i think i've read most of what you've written on the internet... as far as i can tell).

i would usually spend time calling things out but there are too many spots; at a high-level, your basic premise is that founders should have a "strong" cap table. this is obvious as it is self-evident. but, i imagined you would then provide a strong argument as to why... and this is the only thing i could find that answers that simple but fundamental question:

> These investors can connect you to other investors for later rounds and set you up for a longer term future.

... but i had to reach to find the connection... cause every investor does this... you've provided very little in addition to what investors already executes against. my assumption is that you're argument is that a MORE diverse cap table will create more diverse connections for the founder... and although that might be true, real "diversity" in reality is a luxury that few founders really have... most will take money b/c they just need to survive and diversity isn't something you give a shit when you're dying.