This is the (long awaited) second part to Fundraising Without YC - The Preparation. Now that you have set the cap, asked for intros, and created your pitch deck, you are ready to run the process. If you are not a YC founder you do not have the benefit of Demo Day to help with your fundraising. There is no day where a deluge of investors will come cold inbound and want to write checks to invest. Therefore, you need to create your own mini Demo Day by creating momentum.

Prioritize Velocity

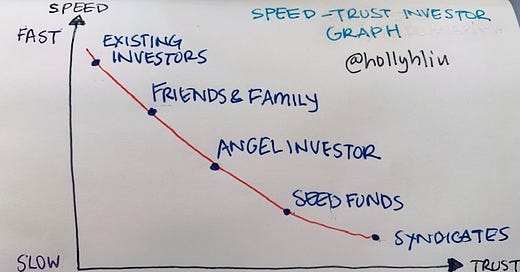

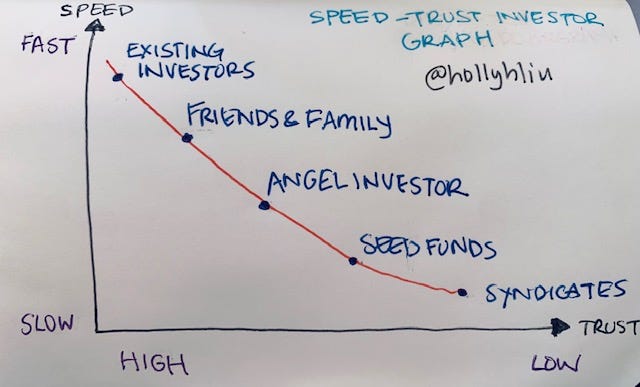

If momentum is what you are after, then velocity is the first thing you need. Therefore you should prioritize speed. Prioritize investors that move quickly to create momentum. This means prioritizing friends, family, existing investors or those that know you first. Those who know you and are closer to you will not only move faster but will tend to have higher conviction with less evidence. When we talk about the “friends and family round” we are really talking about your ex-tech job network or people who know you from industry. You can raise money from your grandma and your uncle, but just be careful 1. If you do not have “friends and family”, you will need to prepare for intros. 2

In general, angel investors tend to move pretty fast along with micro funds (solo GPs or 2 partners). You should prioritize angels and micro funds so when you have your conversations with seed funds you can tell them that you already raised X% of the round. You will also get to practice and build confidence with your pitch which will help you convince investors and larger check sizes later. Once you have the first check in, ask the investor (1) if you can let other people know they invested and (2) if there are other investors that might be interested. But only take the intro if they have already committed money. Repeat these steps until you have a healthy pipeline to fill your round. Combine these names with the list of intros you do in the Intro Preparation.

Oftentimes for a wedding, the bride and groom are advised to have an A, B and C list for guests. I recommend the same types of segments, but for investors. A-list investors are the investors that will move the fastest and know you well, where C-list are investors that move the slowest and don’t know you. If you go after your C-list first, you run the risk of not creating momentum and eventually not raising the money you need. I have seen founders go after the big fancy names, waste their time and then go back to angels and friends/family.

Timebox the Process

You are either fundraising or not. 3 Timeboxing the fundraise process will help you focus. If you do not set a deadline for yourself, it will be hard to go faster. This is true of many goals, the more you focus, the more progress you can make. On average the seed round can take up to 3-4 months. That time frame depends on how much momentum you have in the fundraise.

Create Meeting Density

Unfortunately without Demo Day, you have to create the momentum by booking as many meetings as you can close together. Density of meetings matter because it creates momentum for you as the founder during the fundraise.

You can build momentum by having a lot of meetings lined up in a short amount of time. One non-YC founder scheduled 50 meetings within 2 weeks. It is important to time box the scheduling. You don’t want 2 meetings a day over several months. You lose momentum.

The momentum also helps build continuous improvement with your pitch. Be wary of advice whiplash.4 Make sure each iteration and change is an improvement to help build momentum in the fundraise.

Investor Meetings

A Little Help

Co-founders who are not the CEO can help out. Oftentimes the CEO is doing the fundraising by herself because it's more streamlined to maintain a single point of contact for the fundraise, and the other co-founders can continue to grow the business. A co-founder can help with warm introductions to others in their network. If the introduction is a warm intro from your co-founder you should pass them off to your CEO or bring them along for the pitch meeting. Sometimes the investor will want to meet the entire co-founding team. This is all very normal at seed.

While not politically correct to comment, I have heard from many female founders who raise that it’s different when they bring their male co-founder with them. I suggest you A/B test this, and if it works better for you to bring your male co-founder, you should game plan which part each of you speaks to. The positive aspect of bringing a co-founder with you is that you can debrief each meeting together and iterate.

Agenda

During the seed stage or first meeting, the meeting is really more of a conversation. Zoom has reduced the formality of the meetings. Usually the investor meeting is set for about 30 minutes. The goal of the meeting is to get the investor comfortable and excited to invest. Therefore, the founder should have a conversation that hits the main points of your pitch. Oftentimes the investor has had way more of these meetings than founders, and are good at it. However, if you are at the early seed stage you may be dealing with inexperienced investors. The more you practice your pitch, the more you can help guide the conversation. In general, I like to set up the agenda of these meetings as follows:

Investor introduction

I would keep this short but long enough to understand at a high level their investor focus, and why they wanted to chat.

Company overview

Spend the bulk of the meeting talking about your company, starting with what your company does and then hitting the main points of your pitch at some point during your conversation. The best investor meetings are when the investor learns a unique insight: something new and surprising about your industry , even better, your users. I personally look to understand what the company does and whether people want its product (traction). After that, I look at market size and the team.What is the unique insight or secret sauce that makes this team the one that wins in this market? Oftentimes it is early at this stage, but the founder knows the company the best and it’s up to the founder to communicate clearly what they are trying to build. 5

Closing

This is where you talk about your fundraise. The investor will likely ask what you are raising and at what valuation cap. Often the investor will also ask how much of the round is filled and how quickly. Sometimes the investor will ask who else is in the round or who else you are talking to. If an investor has committed to the round, you can say their name. If not, you can speak of investors you are talking to in general terms: “prominent seed funds or prominent angels.” This is why you need to be prepared. Make sure you ask some closing questions listed here so you are aware of the next steps and can manage the process.

Is this something you’d be interested in investing in?

What is your typical check size?

What is your process?

Do you invest in this industry?

How many checks do you make a year and how often?

How do you like to work with founders you have invested in?

Deck or no deck?

This depends. I’ve seen founders present via Zoom or over coffee in the pre-pandemic world. I personally prefer the conversation without a deck, so I can focus solely on the founder and what they are saying. I’ve had some form of email exchange and hopefully some great juicy tidbits in your introduction blurb. If you do present a deck during the conversation, please make sure the deck is not confusing or distracting to what you are saying. I’ve often tuned out because I’ve been so distracted by the slides.

Changing the Valuation Cap During the Process

One thing that could happen is your valuation cap (or “cap”) changes during the process. 6 In general a founder will raise their valuation cap during the fundraise if there are more investors wanting to put in more money than what the founder is raising. The round is oversubscribed. If the founder drops the cap, this means not enough investors are biting, and the round is undersubscribed.

Changing the cap has trade-offs. In terms of founder dilution, raising the cap can help preserve founder dilution, but at the same time you have increased the bar that you need to clear by several multiples on your next round of financing.

If you change your cap in the process, it’s customary to change it for all investors either going forward in the case you are oversubscribed. Or in the case of being undersubscribed, and you decide to lower the cap, you will need to do so for all investors who have invested prior to the higher cap.7

Communicating During the Process

Founders to Investors

As mentioned before investors don’t move quickly unless forced to. The best way to get investors to move faster is to continue to communicate during the process. The best things to communicate are the following: (a) if the round is quickly filling up (and you want that investor) (b) if a big name investor comes into the round (and they give you permission to tell others about their investment) - yes, investors think like a herd or (c ) you have closed some great customers, got some great growth. Any one of these can be a forcing function to get the investor to respond.

Founders to their Team

CEOs, keep the other co-founders updated on the raise, as they not only can help out with emotional support but also they will feel more a part of the process. I know many CEOs take the brunt of rejection of fundraising, but know that you have a whole team with you being rejected. If you don't share the ups and downs, there is no way the co-founder can help you up when you are down or celebrate when you are up. Not being transparent and communicative in the fundraising process can drive mistrust between founders, it’s something simple and should be done.

Commitment vs. Closing

Commitment is getting a soft commit of the investor’s interest in the form of investment amount and at a specific cap (usually the cap set out by the founder). The founder will then need to say yes or no to their offer. You do not need to accept any investor’s commitment right on the spot--in fact, it is not recommended. At least take one evening to talk to your co-founder and advisors and consider allocation needs if it’s a big check. Accepting investors on the cap table is difficult to undo so it’s okay to take at least a day to sleep on it. If an investor is pressuring you to take the money right then and there, you will have to think about how this will reflect future behavior.

Closing is getting the signature on the SAFE and money wired. This can be done separately but in parallel. And if there is anything I have learned, nothing is final until there is money in the bank.

Making room for everyone

A common tactic non-YC founders use is to save a chunk of allocation (or round) for angels and/or friends and family at a discount or a lower cap. They will go to the angels/friends and family first, get commitments on that lower cap. The founder will also accept their commitment. Then as they fundraise from the seed funds, they can tell them % of the round committed and who the angels are if they are prominent. This is akin to YC founders raising capital right before Demo Day, so they don’t go into fundraising with nothing committed. Then they will circle back and close the checks at the agreed upon valuation cap.

Handshake Protocol

To help clarify commitments to close, YC created the Handshake Protocol which is a simple process to confirm commitments in writing, making the close a lot easier. And, once the money is the bank, you can breathe a sigh of relief and get back to building your company.

Fundraising is incredibly distracting for the founder and one of the least enjoyable activities; however, if you are organized, prepared, and stay engaged, you can shorten the process as well as set yourself up for future fundraises.

** Disclaimer: Please note that these fundraising articles are aimed to those that are raising money from VCs. This is general advice but each case is different. If you wanted to chat about your situation feel free to connect with me here.**

If you get the opportunity to do YC, I highly recommend it. The application is open to everyone, and they take rolling applications! Over 50% of the YC batch has applied and been rejected before getting into YC. The beauty is that you can always apply again for YC. If you do get a YC interview, congratulations! I’m happy to chat before your interview.

However, I would caution just like fundraising is not the end goal for a startup, getting into YC is not the end goal. For those that do not take the path of YC, I recommend these tips in fundraising to raise the capital you need to build a successful, long-lasting company.

🙏Special thanks to Jen Liao and Karen Hong for reading soooo many drafts of this article. I finally posted it! :)

❤️Sharing is caring. If you think someone could benefit from this newsletter or post, please share! ❤️

There are many funds now who focus on pre-seed round, which is also the “friends and family round” They can be done interchangeable and be called “first money in”

Advice whiplash is when founders go to several trusted advisors on their deck and one advisor says one thing, another advisor says another thing and soon you have an amalgamation of advice, averaging to bad advice.

I find that practicing for these investor meetings is a lot like practicing for a date. It’s great to do a couple of mock dates for you to be comfortable talking about yourself, but the actual date can go in many directions because it is a conversation. The more comfortable you are with yourself, the easier it will be to guide the conversation helping you put your best foot forward.

Beginner note: If you are raising $1M on a $10M post money cap, you are selling 10% of your company (1/10). The second number ($10M) is the valuation cap.

In rare cases, if the investor is strategic and value-add, such as YC, investors who have invested at a higher valuation cap will be fine with having someone like YC on the cap table at a lower valuation cap because they know YC will provide so much value, higher than what they invested at.

first, where the fuck have you been?! we need more of your good writing.

good timing as tons of folks will need this to salve temporary wounds... and get back to work.