I spent two years at Y Combinator (YC) from 2018-2019 as a Visiting Partner working with hundreds of founders. It was a wonderful experience and I recommend YC to many founders. We founded our company in 2006, the year YC was on the East Coast focused on recruiting students. By then, we were already 2-3 years into our professional careers and on the West Coast. Suffice it to say, YC was not really an option for our company. After seeing the magic of YC, I often tell founders that starting a startup is like rowing in the open sea in a rowboat with your co-founders. Without YC, it’s like rowing with chopsticks. With YC, you get real oars and a wave maker for your fundraise with Demo Day. YC is incredible, and has open sourced a ton of their advice, including fundraising a seed. Even if you are not a YC founder, I highly recommend their library on all things startup.

Since leaving YC, I’ve worked with many non-YC founders across different organizations at AllRaise, Mozilla, and my personal network. I learned how founders fundraise without YC. It can be more difficult but still possible, and honestly their hacks are clever. These founders need to focus on the process as much as the pitch. 1 If you find yourself in this category, the next two articles will discuss what you can do to raise your seed round successfully.

First truism about fundraising: Investors by default are not incentivized to move quickly. They will want to get as many data points as possible - traction, what other investors are in the round, etc. before deciding to invest. Remember it is the investors’ job to be meeting as many qualified founders as possible to make their investments, and it’s a year-round activity. It is up to the founder to convince the investor to invest on the founder’s time frame so the founder can go back to building their company. Without the power of YC’s Demo Day, non-YC founders will need to help create momentum in fundraising.

The key to any successful fundraise is to build momentum among investors.

Because a good fundraise is dependent on momentum it is important to prepare for it, particularly as a non-YC founder. Therefore I will be breaking up this topic into two parts: The Preparation and The Process. This article will focus on The Preparation. If you are a non-YC founder, the preparation will include setting up a process that you can execute well. You don’t want to get a lot of meetings lined up but not have figured out how much you want to raise or at what valuation cap. And, if you need to build momentum, it is best to be prepared so you can focus on harnessing the momentum well when talking to investors. Because of this, fundraising is a binary mode: you are either fundraising or not.2

How Much to Raise

Outside of YC, I tell founders to think about how much capital they need to get to their next milestone. For most founders raising a seed, their next milestone is a Series A in 18-24 months (but raise enough to last 24-36 months). Setting the cap should be a function of dilution. If you only sell 10% of your company at seed that is really good, but look to sell 20% and no more than 25% at this stage. This is inline with advice given to YC founders.3

I have seen more non-YC founders raise money but not set a cap, wanting an investor to determine the valuation. This is a very dangerous decision that often backfires. What happens when the investor hears that you have not set a cap, then the round is uncapped. Uncapped rounds means the valuation cap is determined at a later date, and the investor will just wait to see what the valuation cap is before investing.4Not a great way to build momentum. The beauty of a seed round and the SAFE (Simple Agreement for Future Equity) is the founders set the terms instead of the other way around.5 Also if you realize that there are more investors who want to invest than you anticipated, you can open up a new SAFE at a higher valuation cap to protect dilution. The power is in the founders’ hands.

Post Money or Pre-Money: As of 2019, the world changed to post money valuations on SAFEs versus pre-money and convertible notes.6 For investors it’s easier for them to track dilution , but for the founders this means they need to be vigilant on how much they raise at what valuation.

The cap can change, but it will need to change for all investors either going forward in the case you are oversubscribed. Or in the case of being undersubscribed, and you decide to lower the cap, you will need to do so for all investors who have invested prior to that point.

Pitch

An entire article could be dedicated to the perfect pitch; however, oftentimes I find that founders focus so much on the pitch deck and don’t put as much work into their one-liner and introduction. This is a very costly mistake for all founders, but more so for non-YC founders.

Introduction Blurb

Before you have a meeting or an introduction, preparing your pitch is incredibly important. But not as important as what you say in the email itself as well as the first words that come out of your mouth. A good introduction blurb has the following elements:

Company name

Company Description (One-Liner)

Problem / Solution OR How It Works (optional)

Traction (if any)

Team (hilight impressive things about them that is relevant)

Market (optional)

You should open with the company name and brief description of what the company does. A good description is short and leaves a clear picture in the head of the reader or listener. Oftentimes, founders think this needs to be their vision and mission statement all crammed into one. An investor is not your customer, so you should drop the jargon. You are not trying to convince the investor to use your product, you are trying to convince the investor that many people love or will love your product and ultimately invest. But an investor can’t pay attention to anything you say going forward if they don’t know what you are building. A good company description has several characteristics: concise, matter of fact (plainspeak), and leaves the investor wanting to hear more. Some people add in an impressive stat. The company description, pitch, one-liner should be concise and clear. Right after that aim to be impressive. If you can do that together, then you have a winner. The shorthand Silicon Valley tends to like “X for Y”, where X = multi-billion dollar company.7

All the elements afterwards should be in the order of most impressive to what you are building. To the extent you have traction, bring that up towards the beginning.

(Manufactured) Example:

Please meet Jessi Schaepher, CEO and founder of PetPill, which allows any pet owners to directly deliver their pet’s medicines in easy, usable portions. You can think of it like the Pillpack for pet medicines. Since launching a few months ago they have grown revenues 10% weekly, and just signed up the largest veterinary clinic in the US. They charge a $10/monthly subscription fee, and with 136M households with pets, they are tackling a $16B market. They are a team of previous execs from Chewy.com and Pillpack and went to FancySchool. They are raising a seed round and would love to talk to you.

Pitch & Deck

Most founders have two decks. The purpose of the deck attached to the email is to convert to a meeting. Sometimes this is referred to as a “teaser deck”. I have seen some founders use Loom to introduce your teaser deck. The teaser deck should have just enough to be a short commercial. It could be more of a visual representation of what is in your introduction blurb.

The purpose of a meeting deck is to close the money or get to the next meeting to close the money. I have seen founders also pitch without a deck at this stage. If you use a deck during this meeting you want to make sure you follow great rules to a well designed deck with a compelling narrative (following the points of the introduction blurb). Nothing is worse for an investor than to get distracted by the slides because the founder is saying something different from what’s on the slides or the slides are too distracting. Remember (1) the slides are to supplement you and make you as the founder shine and (2) when the investors are reading your slides they are not listening to you. And, even when you are pitching over Zoom you should practice your pitch.

Intro Preparation

Non-YC founders will need to work extra hard on this front. Demo Day pulls in so many investors that introductions are not as needed. For the non-YC founder, you will need to pull intros from your network for meetings.

In order to get meetings lined up, you need to reach out to your network of investors. But if you don’t have a network of investors, I have seen founders spend several weeks lining up introductions.

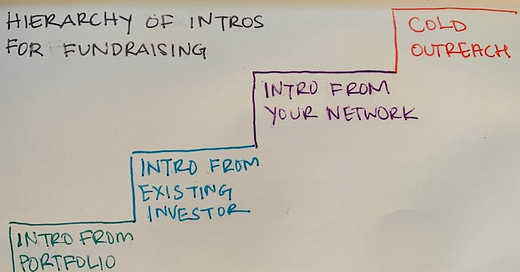

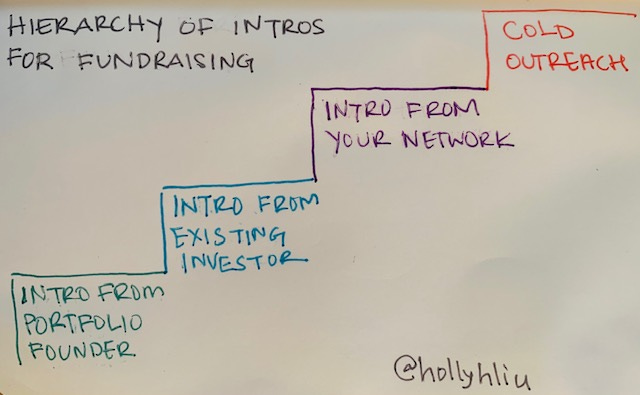

Hierarchy of Introductions

1. Introduction from Portfolio Founder

The best introduction is from a founder to their investors. If an investor has invested in that founder (portfolio founder), ask that founder to get an introduction to that investor. Many times investors will welcome introduction to other founders from their people they invested in, with the thinking that “great talent attracts great talent.” In general, founders tend to be a helpful bunch to other founders (Trust me, misery loves company, and founders love paying it forward!) But founders are also very busy so make the intro as easy as possible, meaning a forwardable email and also a re-ping if they have not followed through.

Post-pandemic story: A founder who was not the CEO of his previous company so he did not have a lot of investor relationships decided to use his founder network. He connected with his founder friends and told him about the idea. He used this time to get feedback and work that into the pitch. When he felt the pitch was ready he asked for introductions to their investors. The clever thing about practicing their pitch with a founder friend is that by the time he asked for the introduction, the founder was familiar with his company and able to pitch it for him. Still, make the email easily forwardable and tailored for the intro. But, by doing this you get “buy-in” from the founder friend. And, maybe you can ask them to invest themselves ;). All of this work led to most meetings to be scheduled in a 2 week time frame, and was able to close his round within a few weeks.

2. Introduction from an Existing Investor

The next best introduction is through existing investors if you have any. Oftentimes many investors will either co-invest or “talk their book”. Only take the intro if they have already committed money because the first thing their investor friend will ask is “Did you invest?”. If the answer is “no” then it’s a bad signal and kills the possibility of raising money. 8

Pro Tip: Practice your pitch with other founders and existing investors. Ask them these two questions: (1) What parts were confusing for you? (2) What parts were not inevitable? Existing investors can give you the point of view of the investor.

3. Intro from your Network

This is where LinkedIn can come in real handy. If you do this, you will need to be incredibly targeted on which investor you want to reach and the who in your network you take the intro from. You will also need to manage your networks and contacts through the whole process.

Pre-pandemic story: One founder never had any coffee chats (pre-pandemic) for her Series A and went straight to partner meetings to close because she managed introductions really really well. She created a spreadsheet of all the investors she wanted to get contacts with, and then she asked her network on who could make a warm introduction to that person. She went the extra mile and managed that spreadsheet by sending reminders, customized emails that were easily forwarded as well as follow ups. Leveraging her network and managing the introduction process enabled her to do really well.

4. Cold Outreach

A very well-crafted cold outreach can have a great response rate. The best cold outreaches have been when the founder is incredibly targeted and specific on what they are looking for with the investor. This means do your homework ahead of time and know if the investor invests in your stage as well as industry. Also be prepared to have more meetings so that the investor gets a chance to know you.

While getting intros is not an easy task, this hierarchy can help you in creating your investor spreadsheet so when you are ready to reach out you are prepared. Great preparation will lead to momentum. This momentum can help you close your seed (or pre-seed) round faster and get back to building your business.

If you spend some time on the preparation of the fundraise, you can run a tight process, enabling you as the founder to get back to work on building your business. Next, we will talk about the process for a non-YC founder… stay tuned!

🙏 Special thanks to Jen Liao and Karen Hong for reading drafts of this article. Special thanks to the founders at All Raise, Mozilla and all those founders who let me advise on their process. Of course, special thanks to YC for making it easier for all the founders to fundraise.

❤️Sharing is caring. If you think someone could benefit from this newsletter or post, please share! ❤️

This is super timely as our startup is gearing up for our first raise soon. Thanks!

cool! sharing this in the newsletter tomorrow.