Photo by Barbara Rezende on Unsplash

Well it’s been quite a few weeks. It is clear that things are not normal and we must get used to a new normal. Every conversation begins first with COVID talk, and then to the work at hand if you are lucky. We are distracted to say the least. And now it’s not Life and Startups, it’s now just life.

Last time, I shared about developing a mental toughness while going through the 2008 Financial Crisis. After two weeks of adjusting to a new normal, I think it was trite of me to think that the Financial Crisis and the Coronavirus Crisis are more similar than different. I doubt that anyone predicted in 2020, a recession would be caused by a shutdown from a pandemic with its own timeline. However, many of the fears, stress, anxiety and feelings are just as real. Some of them are: uncertainty, not knowing where the bottom is, and when will recovery happen? One difference is that we knew what caused the Financial Crises, it was mainly a financial asset gone wrong. In 2008, the economy did not shut down; parts of the economy though did crater. Therefore putting a stimulus package together was simpler but not easier.

Regardless of the differences between the two crises, it produced tough times and uncertainty for startups in 2008, many startups just died that year. We were one of the few that survived. And at that time, like now, surviving means thriving.

You can’t win if you are dead

We started our Series B raise in May of 2008. Our product was doing well and I remember we sat down and our CEO said the markets are good for fundraising perhaps we should start. At that point we were building ad supported communities around TV shows and sports teams on Facebook. Our growth was as exponential as the pandemic. We had grown our registered users to 60MM within 2.5 years [a]. By October 2008 we had signed term sheets for our Series B. Up until then, the speed was phenomenal! You can tell a fundraise is going well by the speed at which the round is closed.

Then the day the money was supposed to be wired was the same day Lehman and Bear Stearns collapsed, ushering in the 2008 Great Financial Crisis. Two days later Sequoia issued their RIP Good Times memo. Suffice to say our funding never came through. We called, emailed and waited. The investors finally called us a week later and said they were too scared. Capital became the most precious commodity overnight and they needed to conserve it for the future. With no investment money coming in, and $3 million dollar revenue contracts disappearing overnight we had to figure out how to extend our runway. It wouldn’t be until 12 months later in October 2009 we would close our Series B from a UK investor. The day the money went into the bank we all breathed a sigh of relief and walked to the local pub. That day our Operations/Office Manager was leaving and she said, “I’m going to hold onto these options, I’ve got a good feeling about you guys.” She would be right, eight years later when we sold for a billion dollars.

Basic Startup Law #1

The old adage, “Fundraise when you do not need the money” does not apply as much during a downmarket. However, this adage applies when the markets are good for fundraising (basically anytime between 2012 - 2019). During a downmarket even if your product is doing well, the investor money (or capital markets) may not have enough to give to your company. They may be conserving it for capital for their current portfolio companies or because they may not know when the bottom is for their own cash reserves. But, if you break the adage to first principles, you get one of basic laws of startups:

Make something that people want

This is why during this time you hear most advice from investors and founders to get to profitability or cash flow positive as quickly as possible.

Basic Startup Law #2

Our time raising our Series B left scars; like people raised during the Great Depression, we hoarded. Anytime we could raise money, we did. In total we raised over $245M dollars of venture capital over our company’s lifetime. Looking back, it was unclear if we needed to raise that much and ultimately meant our return had to be bigger to make a meaningful outcome for the founders, employees and investors. But then again, without raising that capital would we even be alive and grow that big?

Basically we followed the advice, “Take the money when you can” and “There is no such thing as raising too much money”. This advice is better suited for during a downturn. If capital is drying up from your revenues, partners, creditors, it sure will be drying up for investors. Breaking this advice to its first principles, you get another basic law of startups:

Markets are like gravity, they always win.

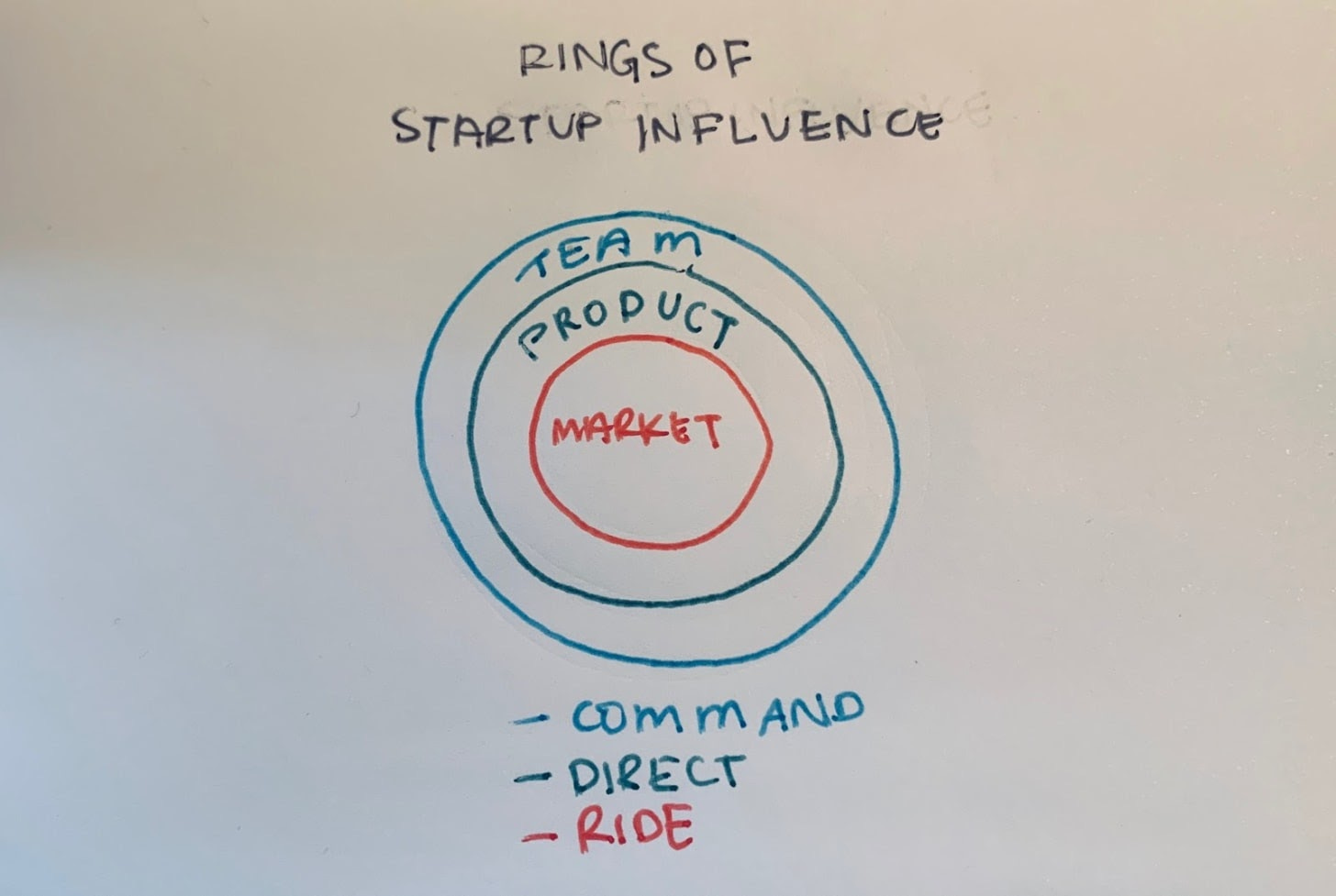

The influence of markets [b] on your fundraise is much stronger than you anticipate, and your ability to control it is very very very small. In fact the only thing you can do when it comes to the market is riding its tides. It is very hard to create waves, but a founder can and should ride those waves.

Fundraising is Like Surfing

Fundraising is very much akin to surfing. If you want to surf, first waves need to be happening. The surfer cannot make these waves happen. The waves are the capital market. The second thing is that these waves need to be at a beach you want to surf at. The beach is your industry. [c] Finally, the most important thing is when the waves are happening you are able to go out there, stand on the surfboard and catch that wave. That you have full control over. That is the operations of your business. Can you build a profitable business?

Our Series C fundraise was completely different. It was 2010, Zynga was preparing to IPO and many investors who missed out on Zynga were looking for the next Zynga. We were growing our revenues to the millions. Investors got wind of us and within a week we closed $30 million in funding from start to finish. For reference, our Series B was $5.5 million. Our game was doing well, but more importantly there were a lot of waves on our beach. What a difference 2 years made if you were in the free-to-play gaming market.

So a couple of things on fundraising during this time:

Get to profitability as quickly as possible!📈 No one is going to save you but yourself. Investors will either be slow or pull term sheets, and you don’t want the fate of your business in someone else’s hands. In general relying on a fundraise (or even an M&A) as a way to save your company is never a good strategy.

How much is enough money?💰 If you can make your runway last for 18 months+ (I know alarmist and conservative!!). But the longer you can make your money last, the better. This crisis is just the beginning; we have no idea how long it will last.

Can I just wait this out? ⌛ There are some founders that I know who believe the economy will bounce back for 3-6 months so they are just waiting with expense cutting. But I would caution some of those founders to consider if the demand will be back to the same levels as before. Recovery always takes time. [d] During this time, maybe you should consider a pivot, especially if your business has just cratered and you are running out of money, like our ad-supported community apps. We did these things that led us into the mobile gaming industry, helping us choose a beach with some waves.

Investors are more unreliable during this time.🙄 Many investors are also thinking about how to make their business (aka portfolio companies) pandemic proof. This could mean they are saving follow on capital for them, spending more time with them (reducing their time in looking at new deals), or considering will this be something that can withstand current events and continue to grow, so they delay to get more data on how you progress. The environment has tipped in the favor of investors who have capital. Cash is king for everyone, including investors. Those investors that have less capital or losing money are becoming fearful. [e]

The deal is not done until the money is in the bank!!! 🏦 This is true during good and bad times.

On a positive note, a startup that focuses on profitability and getting to cash flow positive will be so much stronger for it. The creativity that focus can bring will unlock new markets or new ways of meeting needs. As you are pushed to the limits, you will surprise even yourself. And, when the economy does recover, you will have built a thriving business that you can steer to a positive outcome and exit because at that point you will have waves to actually go surfing.

Determination requires a lot of flexibility and adaptability.

I will be writing a bit more about our experiences of building the company within a crisis.

✍️Sign up for this newsletter if you have not had the chance, I promise to be kind to your inbox 😊

📣Share this post with a friend

👉Follow me on Twitter

🏆In the meantime, be a champ💪and stay on the couch 🛋️you got this!✌️