Photo by Johannes Plenio on Unsplash

It’s been about 2 months since we have sheltered in place and COVID-19 has overtaken the U.S. and continues to ravage the world. Our economy and society is slowly opening up, but without much change to the COVID situation. The only thing we have achieved is not overwhelming the healthcare system in many states (except NY) - which was the purpose of the shelter-in-place.

Therefore reopening society without a vaccine or rapid and frequent testing has become left with more uncertainty. And at the same time with the weather being nicer, Wall Street rallying, and states re-opening, things feel less bleak.

The big fear is that things seem less bleak not because anything has changed, but because we’ve gotten used to this state.

Is it adapt or die or is it adapt or become complacent and then die?

As a founder how do you know you are adapting and evolving or just becoming complacent?

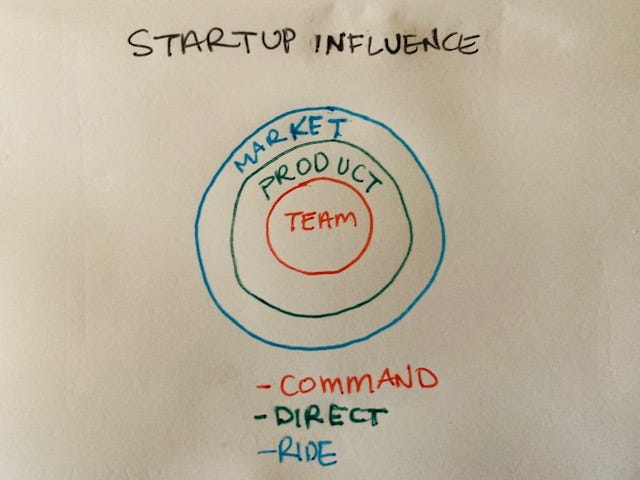

Going back to this graphic below, you can go back to the things you have the most control over (costs and team) which we discussed here , here, and here.

And now you can start looking for opportunities. Looking for opportunities is a way to adapt without becoming complacent. Crisis brings opportunity, even in such a calamity as COVID. However, here are examples of companies that have been pushing the ability to adapt to its finest:

AirGarage: The AirBnB of parking has suddenly seen a drop in their parking lots and has enabled some of them to be used as drive-ins.

Restaurants going purely takeout, this may be a better business model for some as they won’t have to pay for a dining room or wait staff. Definitely better for pizza companies.

Night Clubs going to Zoom

Sometimes cost-cutting and finding opportunity happen in parallel and sometimes it happens sequentially. In this post, I’ll talk about the ingredient you have the least influence over - the market.

For any company trying to raise VC money there are two markets: the fundraising market and your market. The fundraising market consists of investors that look at your business as assets to invest in or in some cases to acquire. Your market consists of how many customers want your service or product.

To make your market grow (or grow your customers) is to get to the elusive product market fit. There are two parts of the equation in product-market fit: product and market.

If you can’t influence the market, it seems like you are at its mercy. While you can only ride waves, you can choose which wave to ride. And, that is the first portion getting to product market fit: choosing the right market.

This is hard to achieve during great times, but what about during difficult times? Not too different. The phase of your company and your goals will dictate how to go about doing this. This is what we did after our first pivot with a team of 8:

As mentioned we had several pivots within our company journey. Our first pivot was moving away from a failing product and failing market. After 8 months and 3 product iterations, we had about 1400 registered users and about 5 daily active users and 20 cease-and-desist letters. It did not take a genius to know that our product had failed and we needed to pivot.

When we came in it was clear that we needed to find a new opportunity, or shut down. We chose to look at choosing a new opportunity. We spent one weekend looking at which way to pivot. One of the things we looked at was markets, but what did that mean? We took a bit of a MBA approach: we looked at industries and applied a SWOT model. [a] We looked at several things:

Industries with a lot of companies with large exits. We were building a VC-backed company so there was a pressure to think about exits at some point. Given we were in Silicon Valley of course we considered Dating as our first industry to move into but we couldn’t find enough companies that had large exits. [b]

Build for a larger industry. Amazon was built initially for books and was able to distribute directly to readers, taking out bookstores and eventually publishers. At the time there was another site that was a popular app on Facebook called Flixster that was connecting movie fans to the movies they liked. They also enabled the fan to express themselves. They were the Top 10 App on Facebook. We thought that like Flixster we could build for TV shows as nothing existed to connect fans to TV shows or for fans to show their love. The only thing that existed were discussion forums at that time.

Growing Platforms. People refer to this as also as technological shifts. Some of these include the internet, Facebook and the smartphone. The number of people using these platforms were undeniable, and made it attractive for companies like ourselves to build huge companies. Layer in a large industry, like entertainment, and you have a chance to make a tsunami. [c]

Existing large companies. I used to feel if there was another company that was doing the same thing as us, the business was doomed for failure. In business the opposite is true, large existing companies prove there is an industry or business model. It just means there are some waves in the industry. It doesn’t mean you will succeed. You will need to make sure you are solving a problem in that industry that is big (see below for more). Google is an example of this. When Google entered search there were already six other search engines. They needed to innovate to not only make it better but also get Google discovered.

X for Y - I had an aversion to copy and paste [large company] for a [different industry] or “x for y”. Examples of this include: “Uber for dog walkers”, “Netflix for games” etc.. It seemed like a blatant rip off. But, I realized when talking to anyone about the company, especially investors, it was so much easier to get people to understand what we were doing. Not only that it helped us understand what we were building. And, when we decided to build on Facebook, we spent a chunk of our time brainstorming big companies that could benefit from having social features.

By looking at these things, pivoted into building Community Apps for TV shows and Sports Teams on Facebook. Entertainment was large and Facebook was a platform that was growing quickly. Within a week of launching we were over one million users and within 3 years, grew the apps to over 60 million registered users.

Once you pick the industry, you want to find a specific problem to solve. Good problems for VC backed companies tend to have several characteristics:

Urgent - The problem is what we call a “hair on fire” problem and not a vitamin. The problem compels the user to have a solution, and there is an immediate solution to their problem.

Valuable - Either the customer or someone else pays money for it. Facebook does not directly monetize their users, but advertisers found the information valuable and would spend a lot of money for it.

Common or Frequent - More than one customer has this problem or the same customer has this problem multiple times. A good way to quickly do VC math is to multiply the # of potential customers X avg annual price = Total Addressable Market (TAM). If the TAM equals to $100M you are on your way for your business to have the potential of being a billion dollar company!

We cannot choose the crises that create the waves, but we can choose which waves we want to ride. We can choose our industry and the problems we want to solve. Once those choices are made, we can decide on the team and product or service to best solve those problems. [d]

It is no longer the survival of the fittest, but survival of the most adaptable.

And who knows opportunity might just show up with the unlikeliest of pairings.

💐 Happy Mother’s Day no matter what form your family takes ❤️

✍️Sign up for this newsletter if you have not had the chance, I promise to be kind to your inbox 😊

📣Share this post with a friend