The Cut

In Life and Startups

In the last few weeks, Americans have filed over 10 million unemployment claims. Many of us know people personally affected. (If you are personally affected, please post here and let folks know of your amazing talents.) We have looked into ways to cut back in our personal lives.For me, I’ve cleaned out my closets and seen how much stuff I have accumulated. Time has been upended, slowing things down and making me realize how many mental and emotional commitments I’ve also collected. This becomes acute as our social interactions move online, and we schedule even the casual and the serendipitous. I am zoomed out. And to make matters worse is when you don’t have the mental energy to attend one more thing … people assume if you are at home all the time, you have nothing else to do.

Some founders need to take stock of what they have accumulated in the form of commitments and refocus the company to make it cash flow positive ASAP. This article is for founders who have been negatively impacted by a crisis and covers how to get your organization back into a state of avoiding death.

Imagine you are in an emergency room trying to keep a patient from dying. You are working against time. This means you may be doing a lot of things in parallel and need a system that biases towards action. Your only goal is to keep this patient alive. This is the same urgency, focus, and direness that you need to approach to making cuts.

The good news is making cuts are 100% in your control.

And, the path is as simple, but not easy:

Set a goal. Create a plan.Manage that plan.

Set a goal

Set a goal of when you need to get cash flow positive and by which date. Another goal is to get to a certain number of months of runway by this date. There are two important things about a goal: a measurable target and time constraints.

Create a plan

Do zero-based budgeting, which is a fancy way of saying start with a blank sheet of paper, to create a plan. Do not import last quarter’s budget and edit from there. If you are having department heads do their plans, have them start with what they need to hit that number.

It is also safe and better to assume that revenues drop to $0. Past crises have modeled it to assume revenues drop by 40% over the next 12 months [a], but to be safe, model it to $0 in revenue for the next 12 months, assuming your business has already been adversely affected by COVID-19. Also, assume there is no outside investment money (from VCs) coming in. How do you plan to manage the company and get to either cash flow positive or extended runway?

Manage to that plan

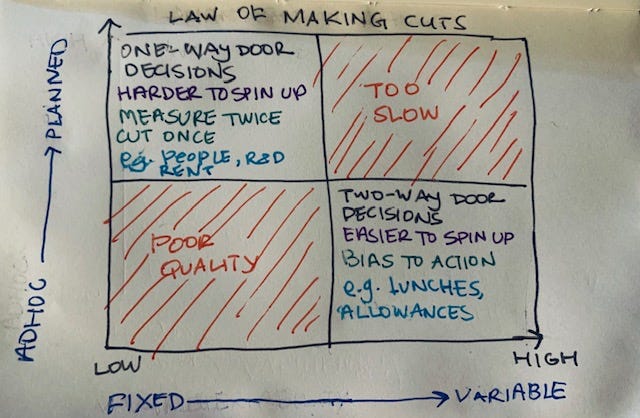

This is the hard part because it requires you to communicate and actually make the cuts. Making cuts is never easy so it’s best to start with the easier ones and then continue to go deeper. Below is a list of things you can try from easier to harder. The easier and more variable the cut, the more you can bias towards action and revise later. These tend to be decisions that are “two-way doors” that are easy to reverse and easier to spin back up. [b] The harder to do the cut and more fixed it is, the more you should plan and decide to just cut once as deeply as possible. These tend to be decisions that are “one-way doors” that are hard to reverse and harder to spin back up.

Re-negotiate vendor contracts

Try to renegotiate everything. At this point it does not hurt to ask. In fact one founder had a plan to extend their runway by 50%. They sent an email to all their vendors. Out of all of them 66% of them gave them a discount from 2 months off to 50% off next renewal. The other portion did not have a policy in place or had not responded. [c]

Just ask

Collect cash faster

You can decide to reduce the price if you think it will either increase volume or retention so much that you make up for the discount. Oftentimes if you are working on B2B you can ask your clients to pay less if they will commit to a longer contract. Whatever is offered to you on the vendor side, you can offer to your clients. If you are B2C, you can give money back guarantees, extend the trial time longer, or as some restaurants are doing - offer gift cards at a discount. Also you can incentivize your employees to bring money into the company faster. One CEO incentivized their Accounts Receivables department by offering bonuses to those that were able to collect more money in a shorter amount of time. They also incentivized their Sales team by moving more of their compensation into variable comp but making it larger. [d]

The reality of running a gaming company is that we have a lot of expanding and contracting in the business. In 2010 we had grown headcount to about 80 people and our revenues to hundreds of thousands daily. Instead of increasing salaries, we decided to put together a company goal around revenue. If the company hit the target we would take everyone plus a guest to Las Vegas. By the time we went on the trip in Jan 2011, we had grown to 180 people.

Never underestimate a common goal to bring people together.

You can be creative about incentives. It does not have to be as big and fancy as Las Vegas, it could be as simple as a day off, a day together with no work, or an evening at Dave & Busters. If you are social distancing, that could mean things that people enjoy together but alone - perhaps a private DJ party or a delivered meal kit to be done together.

Sales & Marketing Expenses

Marketing expenses tend to not only be the most variable, but something you can turn on and off pretty easily. In a crisis advertising budgets are the first to go because of this variability. Marketing expenses tend to fall into two types of spend: performance based marketing (SEO, paid advertising) and brand-based marketing (TV ads, billboards, radio ads). Many companies stop spending on brand-based advertising because it is not only expensive but difficult to measure how effective those ad campaigns were. However, if you are a company that has a budget to experiment with this, then you can get some TV and ad spots for cheap. Now, you will get conflicting advice about paid acquisition. On the one hand because it is performance-based marketing, you know what your ROI should be on it. Therefore if you do not invest now, it will impact future revenues. On the other hand, I’ve seen some companies turn off their sales/marketing spend and their revenues not only held but increased. This is where you as the founder need to understand both sides of your business and make the call because both of these pieces of advice can be right.

If you are a B2C, you can focus on ways either via product or new distribution channels for your product to help you reduce user acquisition costs.

When we launched our first game on Facebook - Kingdoms of Camelot, we had no budget to spend on acquiring customers. The only thing we had was the product itself and our dying communities for TV shows and sports teams. This put pressure and focus on making sure the game was as viral as possible. We baked in some social features that were never seen before in games on Facebook. First, we enabled people who were not friends to play together. Secondly, we enabled strangers to become friends by offering communication tools such as chat and messaging. Then we enabled them to form common quests via enabling them to group together in alliances. We then focused on messaging our dying communities that we were building this new game and some of them took a chance on us in their kingdom in Camelot. Without the pressure, we would not have focused on the social features that made our games a better experience.

Never underestimate a common quest to bring players together.

If you are a B2B company and make sales, they tend to be done by people. Because they bring in revenue, you want to be careful about cutting future cash flow. One thing you can do is move most of your salespeople to a variable compensation model. In fact, you can do this for any type of operations team that directly impacts revenue in a way that can be measured. Make sure the variable compensation is generous to their performance during this time.

People

This is the hardest one of all, because you have made not just commitments but promises to people and in some cases their families. When looking at cutting costs related to people there are other things you can do before saying goodbye to them. First, you want to do a hiring freeze. No new hires until you can at least come up with a plan that you will execute. The previous plans were made for pre-COVID times. Secondly, for those that are directly responsible for revenue, you want to change the mix of fixed to variable compensation. Focus compensation more on variable compensation. Next, you will want to consider pay cuts. Naturally those getting paid more (CEO, executives) will have a larger impact on the balance sheet. If you model out pay cuts will they get you to where you need?

Oftentimes I hear founders say that they wish they would have just done layoffs rather than making small cuts here and there. This is something that is true in general; however, it depends on a case-by-case basis. If you can achieve your goals of extending your runway or getting to cash flow positive without layoffs, absolutely do it! If not, read about layoffs below. My suspicion is pay cuts will work for smaller companies, and can also boost morale.

Once the 2008 Financial Crisis happened our team of 30 shrunk to about 25. We were upfront about asking people to take pay cuts. We compensated anyone who took a paycut in equity. At the time we had raised our Series A and had probably about 9-12 months of money in the bank.

Layoffs

When it comes to doing layoffs, it is better to do this with one cut. This is why you need to take the worst case scenario and make it the plan. In general it is best not to cut then wait a few weeks and cut again. This is painful not only for morale but also makes it difficult to continue to move the company forward with energy and focus. However, if done well, people will come back and thank you for the opportunity of working together and they will speak positively about that part on their resume.

Stay tuned for how to say goodbye.

✍️Sign up for this newsletter if you have not had the chance, I promise to be kind to your inbox 😊

📣Share this post with a friend

Bonus: With this week of loss, it has certainly been painful 😭. But, sometimes, loss will surprise you in a funny way, like for this cat owner 🐈.