As an investor, I’ve had many conversations with early stage startups. While the majority of these conversations have been with the CEO, it is important for non-CEO founders to have a good grasp of what the investor is looking for. The more I learned about the business perspective of the company, the better founder and leader I became. I made sure all of my designs were focused on business goals and expressed them in a way where the CEO could better understand. In essence, we became better aligned and moved faster, which is critical at any stage of any startup. [a]

The fundraising conversations are different from the ones that founders have with employees, partners and customers. The investor has a series of questions that they won’t ask directly, but are trying to answer and determine. The founders know so many things about their company that sometimes they try to share all of it. Ironically, this is a detrimental strategy. It confuses the investor rather than clarifies the answers they are seeking.

An investor is trying to determine if the founder is making something that people want.

The only way investors can determine if you, the founder, is building something that people want is whether or not their customers are spending time or money on their product. Ultimately the users’ time spent gets converted into money or revenue (e.g. Facebook) or directly spent on their platform (e.g. Amazon).

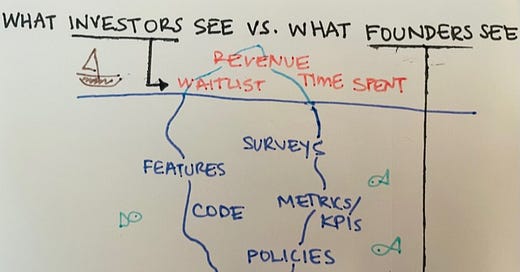

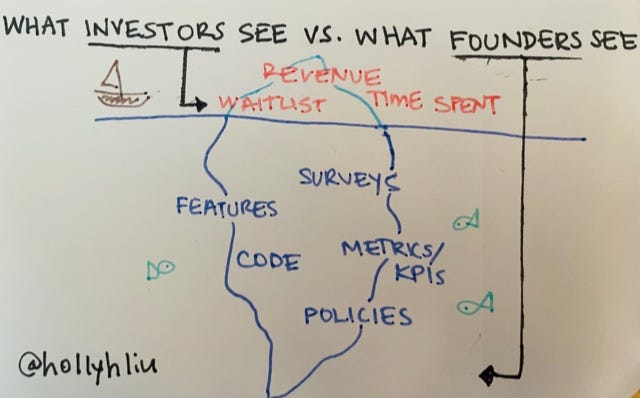

Like an iceberg, investors can only see the top portion of the iceberg: revenue. And founders see the whole iceberg.

The revenue is the summation of the entirety of your business. If revenue is growing, more people want to spend their money on your company, or the same customers want to spend more money because your product is that valuable. The set of questions they tend to ask around revenue are about numbers: How much are you growing week to week or month to month (usually this is revenue and then will dig into customers paying what price, etc..)? If you are charging a subscription, what is the churn? If marketplace or hardware, what are your unit economics? Are you spending money on acquiring the customer? How long does a customer usually last on your platform? In general, when the investor asks the question “What have you learned?”, they are hoping to hear answers to the above, quantified numerically.

Quantify your answers as much as possible.

If your startup does not have revenue, then the investor will try to figure out what other proof points your startup has towards revenue (or making something that people want). The next best proxy investors use for B2C companies are deposits and waitlists, and for B2B companies, pilots and Letters of Intent (LOIs). However, investors expect larger numbers the further away the company is from revenue. For example $10,000 of revenue in paid contracts is much better than $10,000 in LOIs. If you have only LOIs, I expect something higher in the $100K + range.

When you don’t have revenue, the questions you’ll typically hear might sound like these: How did your users find you? How quickly is the waitlist growing? What are the amounts for the LOIs? Who are they with? Why are they signing and LOI with you? What does it take to convert the LOI to a paid contract or pilot?

Rarely do investors care about testimonials and qualitative data. It’s hard for testimonials to be a gauge of real revenue from qualitative data. But for the founder, they’re invaluable information on solution, product direction, and great for growing your customer base. Be wary of the way you use this qualitative data: unless it has had a direct impact on moving the revenue metric, it will be difficult to draw a clear line to making money.

Team

If your company is pre-revenue, the next best thing the investor is trying to figure out: Is this a team that can make a ton of progress in a short amount of time?

There are several things investors will look at here - skill sets and experience on the team, which should yield unique insights as a founding team to enable your team to make a ton of progress in a short amount of time. The faster your team moves, the more attempts you will have at product market fit. [b]

Usually you have this unique insight because of your background and the problems you have encountered as well as what you do with those insights.

Every successful company started as a startup with a secret.

The secret is something you know that everyone else does not know, and it is birthed out of the team, its experiences and perspective. Knowing something and acting quickly on that knowledge are two different things. Questions around your team that impact speed to launch (and re-launching): How long have you been working on this? How much of that has been full time vs. part time? How did the co-founders meet? (aka how long have you known each other and how much trust is built between you and the founders? ) Does one of you write code?[c]

The team is the limiting factor for company potential.

Vision

When investors are asking about vision, it’s best to start out with what you’re doing right now, then build up to what you want to do in the future. This is a better way to build a story.

There are two reasons for this:

1. It brings the listener along with you in your startup story

2. Every piece of logic is a stepping stone to the vision of your company

Your past performance is credibility into what you can build in the future.

If you do your job right, the listener will fill out the ending and arrive at the same vision. But they will be more bought in because they saw how you arrived at that destination or vision. Did you know most cartoon drawings of a hand only have 4 fingers? Your mind draws in the rest. In fact, if you draw 5 fingers it looks weird, and not because I’m a terrible artist.

Vision A: We are revolutionizing your digital identity.

Vision B: We are an app that enables anyone to share pieces of their identity online without sharing your entire identity. You can think of us like Plaid but for your online identity. By doing this we are revolutionizing your digital identity.

In Vision A, as an investor, I have no idea what a “digital identity” is, so I’m not sure what is being revolutionized. Vision B has more words, but it is a story and paints a picture. [d] Remember this is a vision (or pitch) for an investor not a customer.

You are not trying to convince an investor to use the product, rather you are trying to convince them to invest in your company. One of the largest mistakes that founders do is give a customer pitch to an investor.

Investor Pitch:We are an app that enables anyone to share pieces of their identity online without sharing your entire identity. You can think of us like Plaid but for your online identity.

Customer Pitch:We are building the safest most comprehensive way to share your identity online. You no longer need to share all the information on your credit card, only the most important parts.

The investor pitch is much more plainspeak, whereas the customer pitch has a lot of marketing language talking about the benefits of the product itself.

Market

One thing that many investors ask about is market size. What investors are trying to figure out is how many people either have this problem, or how many people will want your solution to this problem.

When investors are asking about market size, it is much better to start by talking about total dollars addressable to your business, also referred to as total addressable market size (TAM). This means How much money can your company possibly make?

The good news is there’s a simple formula:

# of potential customers (*) amount they pay you yearly per customer = TAM

Example: Petpals sells subscription pet food at $12/month

85M (*)There are 85M households in the US with pets. We charge a monthly subscription fee which works out to be $120 a year, giving us a TAM of $10.2B. Next week we will offer pet vitamins for an extra charge, bringing the annual fee of $180, giving us a TAM of $15.3B.

Like vision, it’s better to talk about what you are doing now and then build from there. Therefore start with what you’re currently charging. If you have not started charging, state what you plan to charge instead. Walking the investor through the logic enables them to understand your business model and how you make money.

Two common mistakes:

Citing an external report for market size. Many founders think that citing an external source gives them more credibility, especially if they are someone as respected as Gartner. However, an investor never knows how much of it is calculated in this number. If you are a startup that just focuses on pet food and Gartner says the pet industry is $300B, what else does that include? Grooming services? Vet services? Dog walking services? Booking software for veterinarians? Citing external reports isn’t an accurate picture of the market that is addressable to you.

Haircutting your total addressable market. Many founders, especially women, will do the math for just making 10% of the market. It sounds compelling. 10% of $15B = $150M annual revenue! However, imagine if you got 100% or most of the market, that would mean $15B. The most important factor of growing a big successful startup is to have as large of a market to play in. Don’t limit yourself to a percentage of that market, measure the entire size of the total addressable market to you.

Walking through a math equation for market size does not sound like an exciting story element, but it’s easier for the investor to follow along and build up to the result. Each piece of logic is a stepping stone to the inevitability of not only a large market, but also the team to do it. That’s the feeling you want to leave the investor with.

If the investor can build up to the result together, then you have more buy-in on just how big the market can be. Getting buy-in is the first step to believing the inevitable. It’s that kind of belief that gets the investor excited.

Any story has a beginning, a middle and an end. Different types of stories require different elements. For fiction, characters, conflict, resolution. For an essay, it was a thesis, supporting argument and conclusion. With a pitch, the investor is looking for: an introduction (vision / one-liner), progress, market and team.

While these can be in any order, the investor will be trying to answer these basic questions in these 4 areas. Any pitch that can tell a story that hits all these elements, and gets the investor excited, not only has a great pitch, but also has a great story.

Many of these ideas have been expressed on the YC blog, Paul Graham’s Essays, and I highly recommend you give Aaron Harris, previous YC partner, a follow here, who influenced a lot of thoughts on storytelling at YC.

🙏 Many thanks to Jay Rosenkrantz from Wordloops for reading drafts and providing the space to think and write online. ✍️ Join Wordloops and after 7-day free trial, coupon code for 25% off first month: foundermusings!

a solid overview.