Consolidation in the Worldwide Gaming Markets

Note: This was first published in August 2015 in Tencent Media in Chinese.

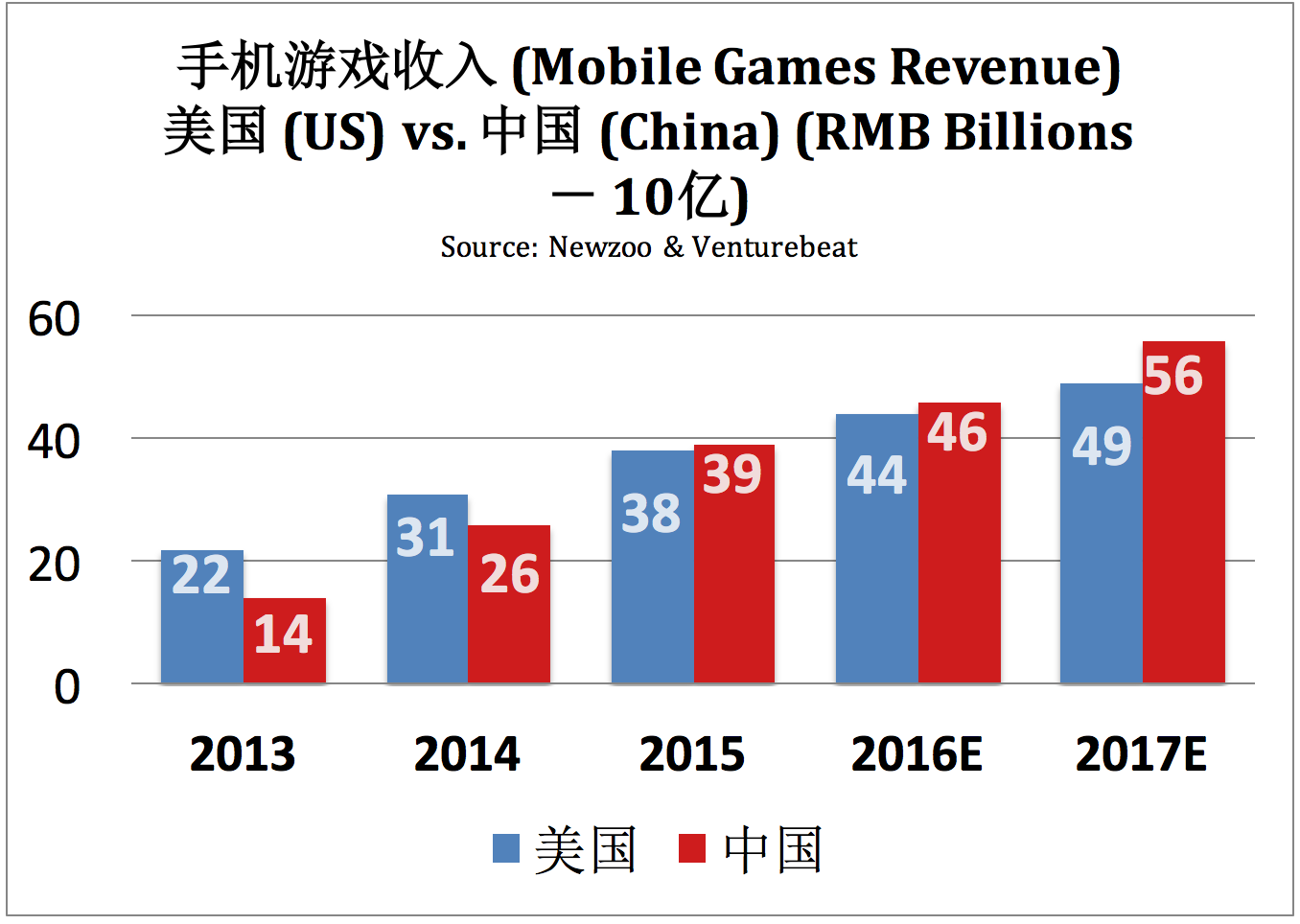

Worldwide, this year the mobile revenue market will make up ~$30B USD, and has grown more than 300% from last year, according to Newzoo. A large portion of this is expected to be from gaming. It is predicted in the Chinese Gaming Market will be responsible for 20% of that revenue in 2015 and will outpace the USA in terms of gaming according to news source VentureBeat. The growth has outpaced predictions, and has leaving many to revise revenue estimates.

We’ve seen this same growth in the US mobile gaming markets between 2011 and 2013. In fact Kabam was not just the Top Grossing Game, but was the Top Grossing App on iOS Apple in 2012. Between 2011 and 2013 there a large amount of capital investment went towards mobile games as companies opened up left and right. Many were moving from the Facebook platform into the mobile gaming platform, including Kabam. This was the renaissance of game development on mobile.

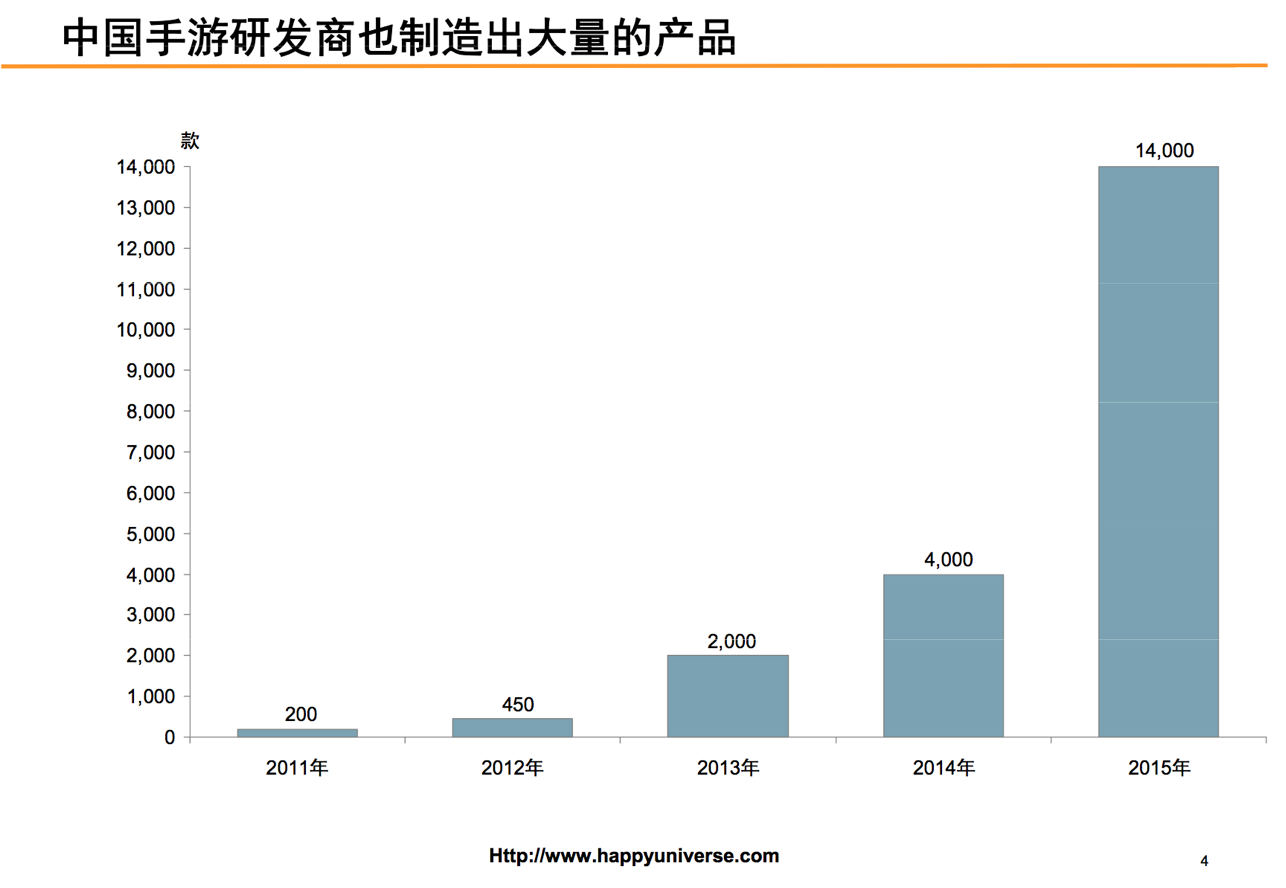

The China Gaming Markets are seeing the same thing. In 2014, there were about 4,000 game developers and by 2015 Happy Universe could only estimate the number of developers to be in the tens of thousands or higher, nonetheless about a 250% increase in content creators.

Chinese Game Developer Growth

Currently, raising capital for mobile gaming in China has also been easier than in the West. From the Happy Universe graph you can see the outpouring of capital birthing so many gaming companies. And the revenue is there. 2016 will be the first year China mobile gaming revenue is estimated to surprass US gaming revenue at $6.6Billion USD according to Newzoo. Chinese investors have been excited about the growth and know that the Chinese have been perfecting game making and its business model for the last 10 years. This environment can only yield great fruit if the right tree is chosen.

At some point the Chinese gaming market will mature, much like the Western Markets. For this to happen two things need to occur: (1) the consolidation of channels, which leads to (2) the consolidation of content.

First, a consolidation of distribution channels happened quickly in the west and is also happening in China. While in the West there are really only 2 distribution channels: Apple and Google Play for the Android Phone, in China there are hundreds for Android. With so many channels, a game developer really has its choice. However, the channel is looking for the very best content to generate millions of visitors and in turn that attracts more game developers, thus is the virtuous cycle for game developers and distributors. In China we are seeing the smaller app stores forced to partner or ally with other stores to survive. We are also seeing acquisitions of smaller channels by larger ones. For example Baidu has acquired 91.com.

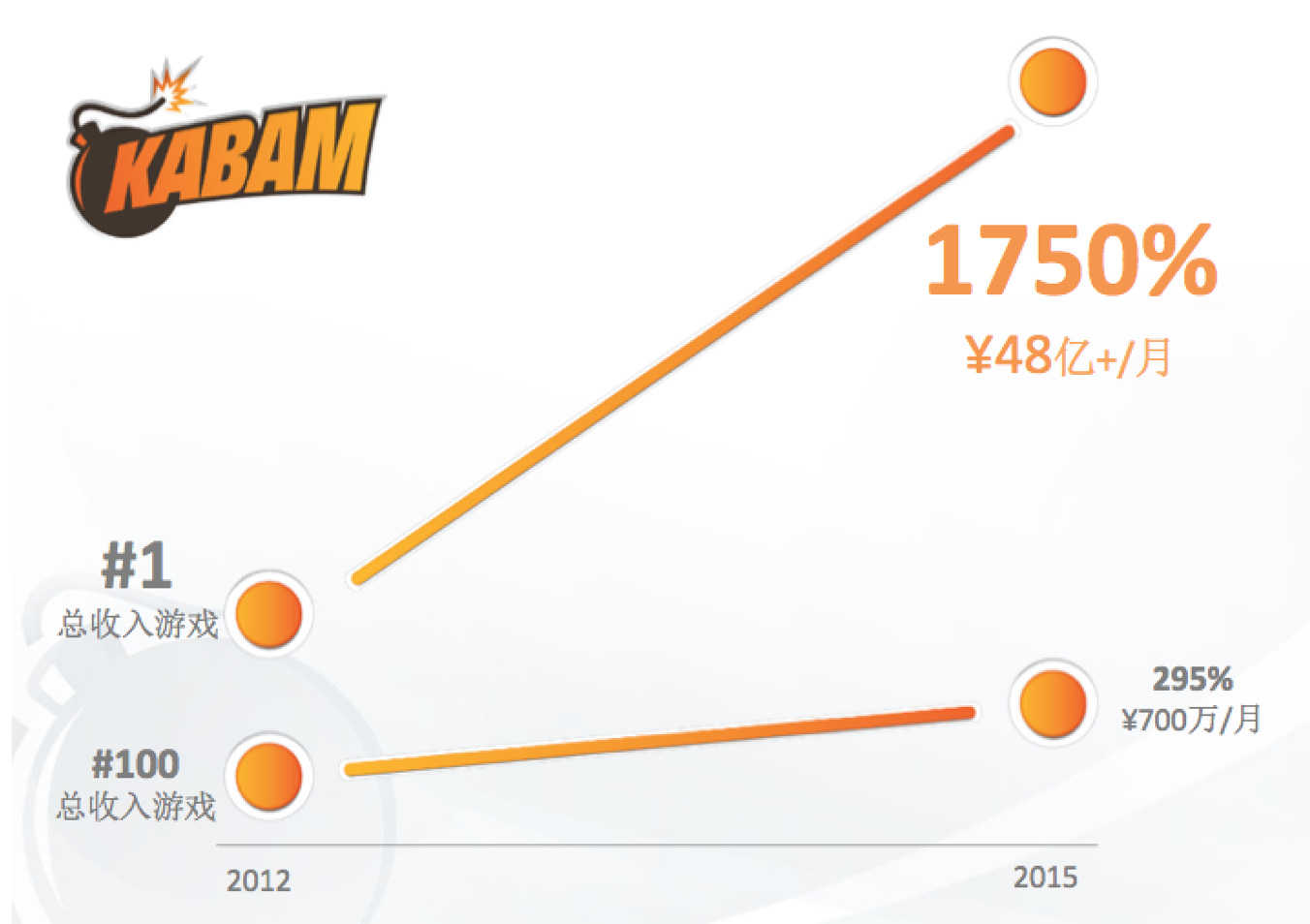

Once the consolidation of distribution channels occur, then the favor turns to distribution channels. When this happens, then the consolidation will then happen on the game developers side. We see this happening in the US. Below is a chart of the #1 Top Grossing Game and Top 100 Grossing games, the percent increase in revenue sits at the top one or the top few games. Between 2012 and 2015, the top grossing game in the Western world grew 1750%. While the Top 100 games only grew 296% in gross revenue.

Source: AppAnnie NA/Europe/Rest of World as of Feb 2015. #1 game grew to $80MM USD/ month, while those games in the Top 100 only grew $1.2MM USD/month

This has forced many Western game developers to turn towards brands while also making sure the game is top quality and evolve their game systems design to be world-class. For the West, game systems that are the free to play model is a new business model, so they are learning a lot. Also the cost per install has increased in these markets. So many have turned to brands as a way to stand out from the crowd. Kabam has turned towards all three of these and on the branding front has deeply partnered with Hollywood franchises and movies to make global games such as: Hobbit: Kingdoms of Middle Earth, Fast & Furious 7: Legacy, Marvel: Contest of Champions, and our latest Star Wars: Uprising. We believe that with brands help cut through the noise and the compulsion to install is a lot higher. Couple that with an amazing quality game with incredible systems design and you have a long lasting game franchise.

While there are different market conditions and different market regulations, China mobile gaming market, I believe, will also succumb to the same fate. The reasons are the following: (1) It is well known that games are the best way to monetize online within the China markets. And Chinese companies welcome this business model. (2) Thus publishers will be driven to find the most monetizing games. (3) Once they find the most monetizing games they will continue to feature it (after their install obligations are met) as interests are ultimately aligned between a game developer and distributor via a revenue share deal. This will make it harder for new entrants to make it. Competition is harder as the channels are fewer.

Now, it’s more important than ever for game makers from both the West and the East to globalize their games to ensure that their game can even compete. In this new world of consolidation, new entrants are difficult but not unheard of. Surely, if a new game breaks into the top grossing ranks it should either be a great quality game, leverage brands, or certainly global appeal. Either way it will truly be a great game. So in the new marketplace of consolidation — focus on building great games will be the sure fire strategy of success.