As 2021 started with a hangover of regrets, I began to think about all the things I wish I knew when running and building our startup, Kabam. (Don’t worry this article won’t list all of them, that is for future issues of this newsletter!) Now as an investor, I spend a lot of my time thinking about the quality of revenue and how it impacts the value of the product or company. [a] As a non-CEO founder without a background in Finance, one thing I wish I understood back then was that not all revenue is created equal. This applies at the product level and then gets extended to the company-level, which gets extended to the company’s valuation.

This post is for revenue-generating companies. If you have a background in this, stop reading. Otherwise, consider this article as Revenue Generation for Dummies.

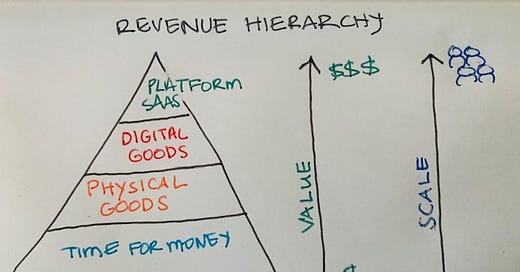

At the bottom of the pyramid is the least valuable revenue creation. Employees, like doctors, lawyers, accountants, or any service-based professional fall into this category. It is least valuable because revenue is dependent on the energy, skill and motivation of the person performing the task. Revenue is also capped by time. There are only 24 hours in a day and about 12-14 of them are spent not working. [b]

As we move up the pyramid, revenue creation is more valuable and scalable. With the internet, revenue creation is scalable and infinite. One line of code released at Facebook can potentially reach anyone who has access to the internet. Revenue can be generated even while the software engineer is sleeping - generating passive income with no inventory to manage.

Revenue multiples, which is how valuation is determined, increase as you move up the pyramid, signaling how valuable the revenue. Traditionally, platforms and tend to get a >10x revenue multiple, Digital Media tend to get a 2x-5x, ECommerce gets between 2x-3x revenue multiple, Services tend to get 0.6x - 2x. Please do your research because multiples are sensitive to timing and can be more or less, depending on your industry comparables and market conditions. [c][d][e]

Our company, a mobile gaming company, was making $400 million dollars a year in revenue. Do you think our company was categorized as (A) Platform / Marketplaces (B) Software as a service (C) Digital good for money (e-books, courses, content, media) (D) Physical goods for money (E) Time for money (employee, consulting, doctor, lawyer, accountant) . Answer at the end of this post.

Outside of the type of business and industry, below are five traits of quality revenue.

🖐️ Trait #1: It’s Sticky

Investors love businesses that create value over time. This means they love businesses that create loyalty because that revenue can be very sticky. In fact a common metric businesses use to measure this is Lifetime Value of the Customer (LTV) which measures the amount a customer pays over his/her lifetime. There are various ways to calculate LTV, but generally it includes revenue and their retention. The longer they stay the higher the LTV can go. [f]

Our games were considered mid-core which meant it had a longer onboarding than most games, which were casual, at that time. However, due to the amount of time a player spent on our game, our games became stickier. Players would invest building their empires and would not leave. Our longest active player in our first franchise game launched on Facebook, Kingdoms of Camelot, was over seven years. For a game, that is considered sticky.

➕Trait #2: It’s Additive

When you begin to get customers, offer features that will be value-add and worth paying for. In some cases, like with a gaming company, you want to be careful not to cannibalize your existing revenue and make sure it is additive revenue, not replacement revenue. Non-replacement revenue expands the customer base.

Since we were a gaming company, every time we released a new game, we had to be careful not to market it to our existing players on other games as it would not expand our revenue but just cannibalize it. Therefore, what many gaming companies do is buy traffic or in our case find new users using different themes.

📈Trait #3: It’s Growing

Growing revenue is simple, but not easy. Get new customers or get existing customers to stay longer and/or spend more. For existing customers, you can provide more services or increase prices. If you increase prices, offset the gain by revenue from customers lost. Sometimes it’s better to focus on the right customer. Because they are giving you revenue doesn't mean they are good for your business.

When we were moving our company to build mobile games and had a great set of loyal customers we were trying to move onto mobile from our web games. After awhile it became clear that not only would these customers move, but they were impeding us from focusing on building games on a new growing platform. Therefore we had to make the tough call to focus on the growing revenue in mobile games.

In the growth phase finding new customers is a priority; however, gaining new customers cannot be at the expense of high customer churn. Many founders raise money to continue growing their business as a main focus.

The focus on growth never stopped. For our Series C we focused on international expansion of our games. For our Series E we focused on strategic partners like Warner Bros to help us grow as we were looking to expand our user base in existing franchises. For our Series E the focus was international strategic partners, like Alibaba, to help us grow internationally.

⏰ Trait #4: It’s Consistent

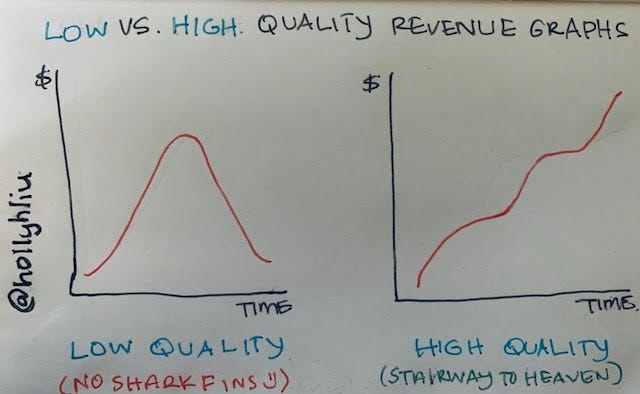

As you run your business, getting consistent and growing revenue is your aim. This is not an easy feat especially as market and industry conditions change.

In our industry, traditional console games at that time operated in a franchise model, like the movies. This means every time FIFA launched a new video game, revenue for that gaming company would spike and then fall back down, looking a lot like a shark fin. (At one point in our company we had an internal rallying cry of “No shark fins!”) Television had an ongoing relationship with their customers, story arcs to keep people engaged. So too our games would have content releases and launch in seasons. The hope was that the content releases would increase consistent revenue, converting more players into loyal customers or giving our loyal customers more premium experiences.

At the product level, we also knew that Flash Sales was a great way to increase revenue; however, we’d always say: “Let’s not mortgage the future”. In other words, there are many tactics that we could do to “spike” revenue, but it was rarely long-lasting. Therefore the more frequently we did this, the lower quality revenue. To change this behavior required a host of changes across the organization, which I plan to write about later.

🔮Trait #5: It’s predictable

If the revenue isn’t growing, then the best thing to do is to be able to predict and forecast your revenues well. This becomes more and more important if you are later stage and closer to eyeing an IPO.

I remember one quarter our revenue grew tremendously but the executives were not happy. When I questioned this, one executive explained that it was more important to be right than to exceed expectations. Our CFO who had taken several companies public always said “Once you go public you need to hit your numbers. Just hit your numbers.”

This is why sometimes a stock of a public company can do poorly when they beat their earnings. It shows the market that the company cannot predict their own revenue, and that is bad. (I am also simplifying greatly in this statement)

As you are providing value for your customers and deciding the best way to delight them, remember:

The company is only as valuable as the revenue it makes.

And the answer is…

Our company, a mobile gaming company, was making $400 million dollars a year in revenue. Do you think our company was categorized as (A) Platform / Marketplaces (B) Software as a service (C) Digital good for money (e-books, courses, content, media) (D) Physical goods for money (E) Time for money (employee, consulting, doctor, lawyer, accountant)

The answer to the question is (C). A mobile company making games is generally regarded as content creation and tends to be able to generate cash flows easily, but has a harder time creating consistent and predictable revenue.

🙏 Special thanks to Jen Liao and Karen Hong for reading drafts of this.

❤️Sharing is caring. If you think someone could benefit from this newsletter or post, please share! ❤️

sending this to a few friends today.